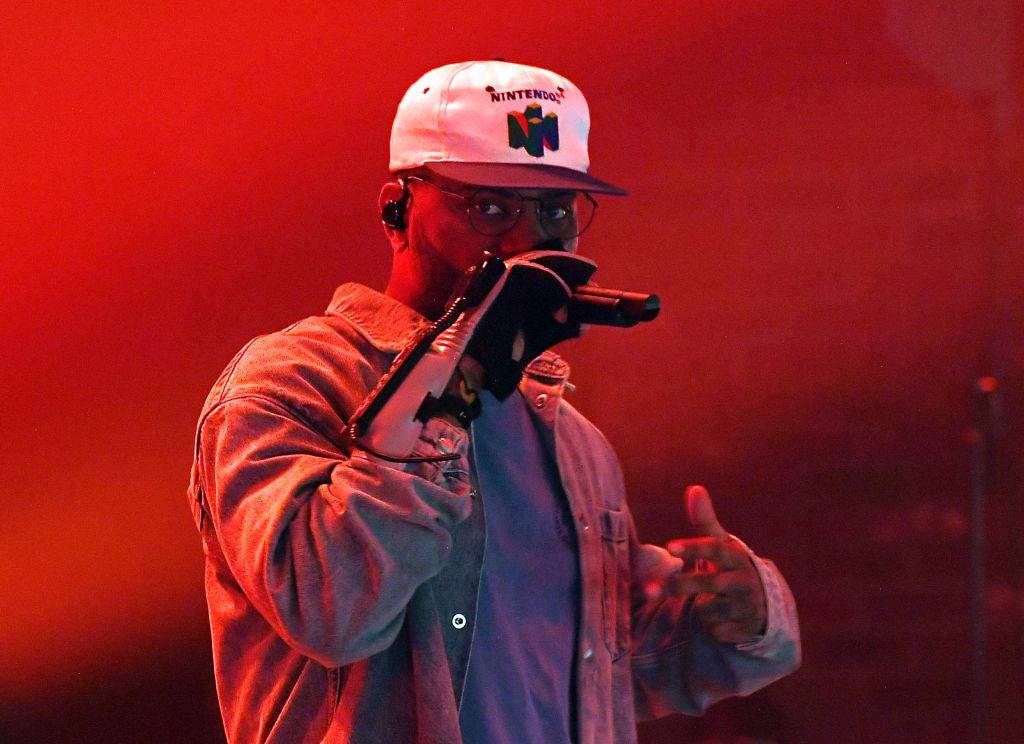

Commentary: David Banner Wants You to Be Financially Literate

Lavell William Crump, better known by his stage name David Banner, is a 38-year-old millionaire.

Crump’s rap career, started in 2000, has since found him starring in major motion pictures and producing songs for other recording artists. It has also made him very rich. But rather than leave behind the very people who have helped propel him to the upper echelons of America’s tax brackets, Banner is now attempting to give back by sharing some of the lessons he has learned along the way.

Banner, who has a college degree from Southern University, was pursuing a master’s in education at the University of Maryland before he left school to pursue music. Following his dream worked out in the end for Banner, but now he’s picking up where he left off and advocating for education in the African-American community, particularly in an area that affects nearly all adults: personal finance.

In a new article in Black Enterprise magazine, Banner offers his top four money management lessons for African-Americans.

“The proper management of money has proven to be a difficult task for many in the Black community,” Banner writes. “According to recent data by the Pew Research Center, the typical Black household has about $5,600 in wealth (assets minus debts) compared to the typical white household, which has about $113,000 in wealth. This 20-to-1 wealth-gap is even more striking during periods of economic downturns.”

You can click on the link to read the article in full, but one point Banner makes seems particularly resonant: “The culture of spending within the Black community has been one of our greatest economic Achilles heels. Simply put, money isn’t staying in our community. For example, the Asian, Jewish and white communities tend to spend money within their own communities first. These various cultures help and support themselves socioeconomically, in part, by spending money this way.”

While that makes a bit of sense, it’s also important to note where Banner’s logic falls short there. Spending within the Black community is all well and good, but one must understand that, when wealthy people like to spend, they’re very often buying things that the Black community can’t provide. It would be wonderful to find a world in which every community had Black luxury car dealers, Black luxury home builders, Black private jet moguls, Black fashion labels, etc. The reality is, however, that right now Blacks aren’t heads of industry the way whites are, so to ask wealthy Blacks to spend in their community is difficult, if not totally impossible.

The opinions expressed here do not necessarily reflect those of BET Network.

(Photo: John Ricard/BET)