Commentary: What Was BusinessWeek Thinking With This Cover?

(Photo: Businessweek Magazine)

Bloomberg BusinessWeek magazine has been making a name for itself in the design world recently with a lot of eye-grabbing covers. Last year, for instance, the publication’s cover depicted two planes in a sexual embrace for a story about a potential airline merger. After Hurricane Sandy, the mag went with a cover photo of a flooded and dark New York City street under the sentence, “It’s global warming, stupid.”

In other words, the magazine has been making an effort to push the limits a bit with its design, especially when those limits are those of the stuffy world of business magazines. But this week that confrontational design finally went too far.

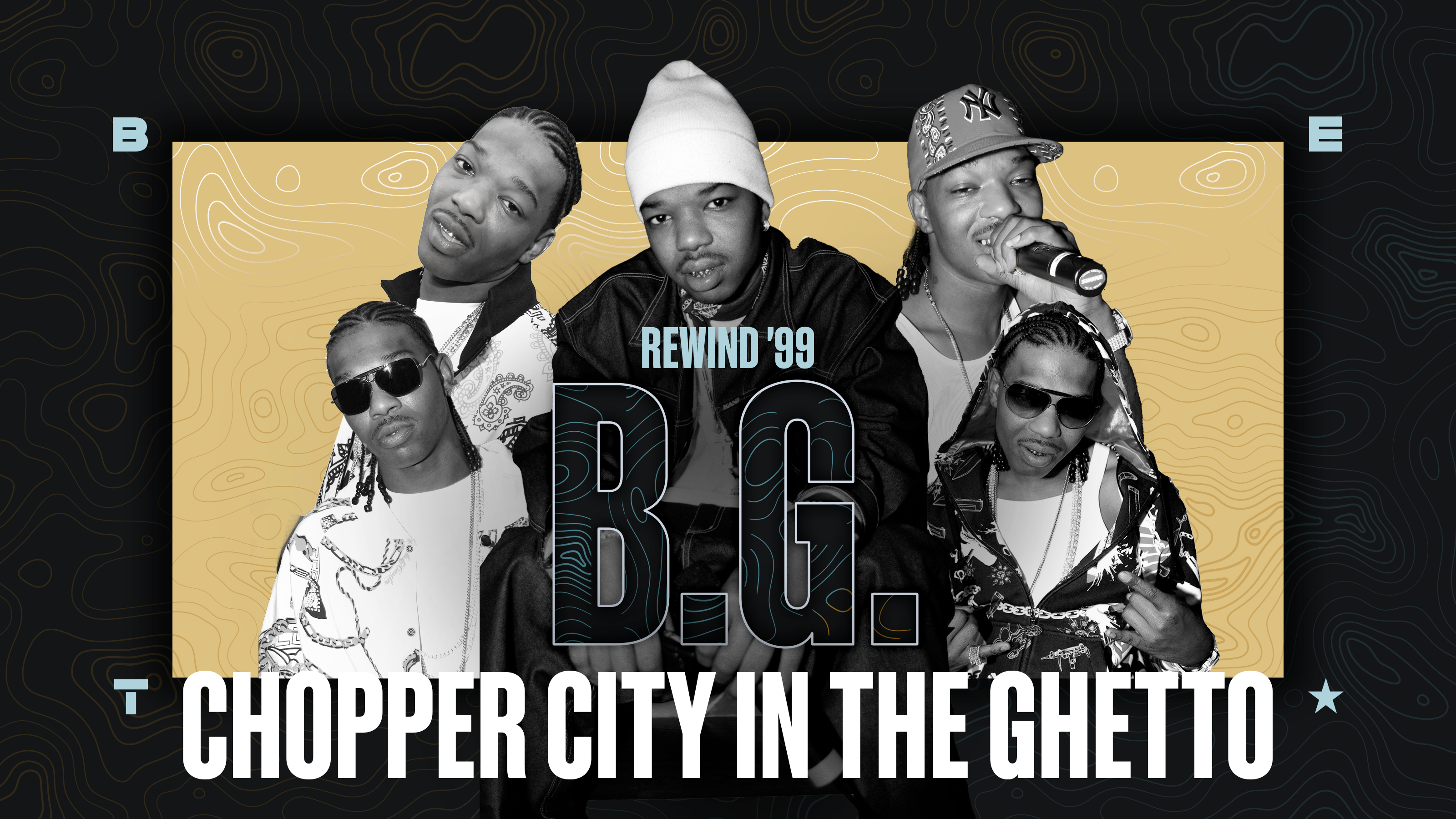

For a story about the return of aggressive mortgage lending, “The Great American Housing Rebound,” BusinessWeek went with an illustration of two Black people and what appears to be two Latinos shoveling money into every nook and cranny of a home as more cash rains from the sky. All of the people’s features are exaggerated — huge lips, for instance — and there is a crazed look in their eyes as they grab for more bucks. Beneath the drawing, the subheadline reads, “Flips. No-look bids. 300 percent returns. What could possibly go wrong?"

The underlying message of the image, whether BusinessWeek meant it or not, is that we haven’t learned our lesson from the last housing crisis less than a decade ago and that Black and brown people getting money for nothing are going to be responsible for that new collapse. Nothing could be further from the truth.

As we’ve known for years now, it’s not minorities who caused the housing crisis, but predatory lenders preying on minorities. Here’s what one sociological study from 2010 said, according to Nick Carey at Reuters:

The study, which used data from the 100 largest U.S. metropolitan areas, found that living in a predominantly African-American area, and to a lesser extent Hispanic area, were "powerful predictors of foreclosures" in the nation.

Even African-Americans with similar credit profiles and down-payment ratios to white borrowers were more likely to receive subprime loans, according to the study.

The fact is that big financial corporations took advantage of disproportionate numbers of poor minorities and helped precipitate a major economic disaster. BusinessWeek’s latest cover tells a totally different story, one that’s less about predatory lending and more about Blacks and Latinos running wild with free money.

The magazine’s editor in chief offered a typical non-apology, saying, “Our cover illustration got strong reactions, which we regret,” but that doesn’t change the fact that that cover illustration is how some people are going to view history years from now: “It was all the Black people’s fault and the rich banks were just doing their jobs.”

Well, that’s not what happened at all, and it’s important for us to not let the same people who make magazine covers like this write the history books.

The opinions expressed here do not necessarily reflect those of BET Networks.

BET National News - Keep up to date with breaking news stories from around the nation, including headlines from the hip hop and entertainment world. Click here to subscribe to our newsletter.

Get ready for the BET Experience, featuring Beyoncé, Snoop Dogg, R. Kelly, Erykah Badu, Kendrick Lamar and many more. Go here for more details and info on how to buy tickets.