Answers to Your Debt Limit and Default Questions

The nation reaches its debt ceiling on Oct. 17.

1 / 13

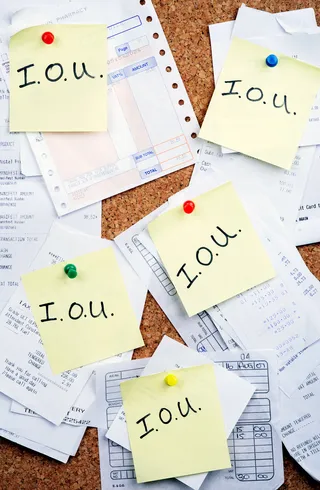

Debt Ceiling Dilemma - With the debt ceiling countdown nearing closer to the Oct. 17 deadline, the nation wonders if Congress will come to an agreement to raise the limit on federal borrowing soon. If the deadline is not reached, then America could, for the first time in history, default on legal obligations. Associated Press and BET.com answers questions the nation wants to know about the possible financial crisis. — Associated Press and Dominique Zonyéé (J. Scott Applewhite/AP Photo)

2 / 13

Q. What Is the Debt Ceiling? - A. The debt ceiling is the cap on how much debt the government can accumulate to pay its bills. The government borrows by issuing debt in the form of Treasurys, which investors buy. The government must constantly borrow because its spending has long exceeded its revenue.(Photo: Andrew Burton/Getty Images)

3 / 13

Q. How Close Is the Nation to the Limit? - A. The national debt reached the limit in May. Since then, Treasury Secretary Jacob Lew has made accounting moves to continue financing the government without further borrowing. Those measures will be exhausted by Oct. 17. After that, the government will have to pay all its bills from its estimated $30 billion cash on hand and tax revenue, which Lew says is not enough.(Photo: Alex Wong/Getty Images)

4 / 13

Q. What Will Happen After Oct. 17? - A. The government could pay all its bills for a few days, according to the nonpartisan Congressional Budget Office. However, sometime between Oct. 22 and Oct. 31, the $30 billion would run out. The date isn't exact because it's impossible to foresee precisely how much revenue the government will receive and when.(Photo: Andrew H. Walker/Getty Images)

5 / 13

Q. When the Government Runs Out of Cash Will It Default? - A. Not right away. A default would occur if the government fails to make a principal or interest payment on any of its Treasurys. The House has approved a bill to require the Treasury to make payments on the debt its top priority. Nevertheless, even if the government managed to stay current on its debts, it would fall behind on other bills.(Photo: William Thomas Cain/Getty Images)

Photo By Photo: William Thomas Cain/Getty Images

ADVERTISEMENT

6 / 13

Q. Couldn’t the Government Simply Print More Money? - A. No. The Federal Reserve, an independent agency, is responsible for creating money. The government funds itself through tax revenue and borrowing.(Photo: Mark Wilson/Getty Images)

7 / 13

Q. If They Can’t Print More Money, What Else Could the Treasury Do? - A. It could make its interest payments first; then delay all other payments until it collects enough tax revenue to make a full day's payments. That would avoid choosing among competing obligations. However, doing so, would lead most other payments such as Social Security and Medicare to be delayed. (Photo/Paul J. Richards (Photo Paul J Richards/AFP/Getty Images)

Photo By PAUL J. RICHARDS/AFP/Getty Images

8 / 13

Q. Would Delaying Payments Avoid a Default? - A. It depends. One problem is that the government would likely have to pay higher interest on new debt. The government, on Oct. 24, must redeem $93 billion in short-term debt. Yet given the risk of a default, investors would demand higher rates on new U.S. debt. Short of cash, the government might be unable to pay off its maturing debt, thus resulting in a default.(Photo: Neil Overy/Getty Images)

Photo By Photo: Neil Overy/ Getty Images

9 / 13

Q. Could President Obama Ignore the Debt Limit? - A. The 14th Amendment to the Constitution says, "The validity of the public debt of the United States, authorized by law ... shall not be questioned." However, the White House has said its own lawyers don't think he has the authority to do so. Nor is it clear that many investors would buy bonds issued without congressional approval.(Photo: Mark Wilson/Getty Images)

10 / 13

Q. What Do Global Investors Think? Are They Panicking? - A. The stock market has drifted lower over the past couple of weeks. But investors aren't panicking. And long-term Treasury yields have been mostly unchanged. Stocks could sink further just before Oct. 17 if the government remains partially shut down and no sign of a deal on the debt limit seems near.(Photo: Ramin Talaie/Getty Images)

ADVERTISEMENT

11 / 13

Q. What Would Be the Economic Impact? - A. No longer able to borrow, the government could spend only from its revenue from taxes and fees. This would ignite an immediate spending cut of 32 percent, the Bipartisan Policy Center estimates. If the debt limit wasn't raised through November, Goldman Sachs estimates that government spending would be cut $175 billion or about 1 percent of the economy.(Photo: Chris Hondros/Getty Images)

12 / 13

Q. Is the Debacle About an Out-Of-Control Budget Deficit? - A. This year's deficit will likely be the smallest in five years, thanks to higher tax revenue and government spending cuts. The Congressional Budget Office projects that the deficit will be $642 billion for the budget year that ended Sept. 30. Though still large by historical standards, that compares with the four previous years of $1 trillion deficits.(Photo: Chip Somodevilla/Getty Images)