Money Monday: What’s Your State’s Financial Capability Ranking?

The results from FINRA Investor Education Foundation’s latest survey are in and it looks like physical location has an impact on one’s financial capability. According to the organization’s 2012 National Financial Capability Study (NFCS), residents of California, Massachusetts and New Jersey are the most financially capable, while those in Mississippi, Arkansas and Kentucky need the most support when it comes to financial management.

This second iteration of the FINRA Investor Education Foundation America's State-by-State Financial Capability Survey builds on the findings and benchmarks established in 2009 and examines how individuals can best manage and make decisions about their financial resources. The data was collected through an online survey of 25,509 American adults (approximately 500 per state, plus D.C.), over a four-month period from July through October 2012.

According to the foundation, the survey detected a significant disparity in financial capability across state lines and demographic groups. Here are some of the key findings:

— Residents of California, Massachusetts and New Jersey who were surveyed are the most financially capable. Those states ranked in the top five among all states in at least three of five measures of financial capability.

— Mississippi stood out as the least financially capable state, placing in the bottom five in four out of five measures.

— Arkansas ranked in the bottom five in three out of five measures and Kentucky ranked in the bottom five in two out of five measures.

— Younger Americans, especially those who are 34 and under, are more likely to show signs of financial stress, including taking a loan or hardship withdrawal from their retirement account or making late mortgage payments.

— Younger Americans are more likely than older Americans to have unpaid medical bills. Of those surveyed, 31 percent of Americans aged 18-34 reported having unpaid medical bills compared to 17 percent for Americans aged 55 or older.

"This survey reveals that many Americans continue to struggle to make ends meet, plan ahead, and make sound financial decisions — and that financial literacy levels remain low, especially among our youngest workers,” said FINRA Foundation Chairman Richard Ketchum, in a press release. “No matter how you slice and dice it, this rich, new dataset underscores the need for us to continue to explore innovative ways to build financial capability among consumers.”

The five measures of financial capability used to rank the states measure how well Americans are managing their day-to-day finances and saving for the future. Here are the national averages among survey respondents for these key measures:

— Fewer than half (41 percent) of Americans surveyed reported spending less than their income.

— Over a quarter (26 percent) of Americans reported having unpaid medical bills.

— More than half of Americans (56 percent) do not have rainy-day savings to cover three months of unanticipated financial emergencies.

— Over a third of Americans (34 percent) reported paying only the minimum credit card payment during the past year.

— On a test of five basic financial literacy questions, the national average was 2.88 correct answers.

The state-by-state results break down financial decisions and literacy by gender, age bracket and region, and highlight how a lack of financial capability has disadvantaged many Americans. The survey also explored topics like how Americans make ends meet, and how they plan ahead and manage financial products.

Click here to get your state’s score, view a clickable map of the U.S., and learn more about how others in your state fare when it comes to making ends meet, planning ahead, managing financial products, financial knowledge and decision-making.

If you’re ready to improve your own financial capability score, check out FINRA Investor Education Foundation’s website. Established to provide underserved Americans with knowledge, tools and skills needed to achieve financial success, the organization’s online resources include Military Financial Readiness and Tricks of the Trade: Outsmarting Investment Fraud.

This article has been prepared for informational purposes only. The accuracy and completeness of this information is not guaranteed and is subject to change. Since each individual’s financial situation is unique, you need to review your financial objectives to determine which approaches might work best for you.

BET National News - Keep up to date with breaking news stories from around the nation, including headlines from the hip hop and entertainment world. Click here to subscribe to our newsletter.

Get ready for the BET Experience, featuring Beyoncé, Snoop Dogg, R. Kelly, Erykah Badu, Kendrick Lamar and many more. Go here for more details and info on how to buy tickets. Sign up now to attend free film screenings, celebrity basketball games and more.

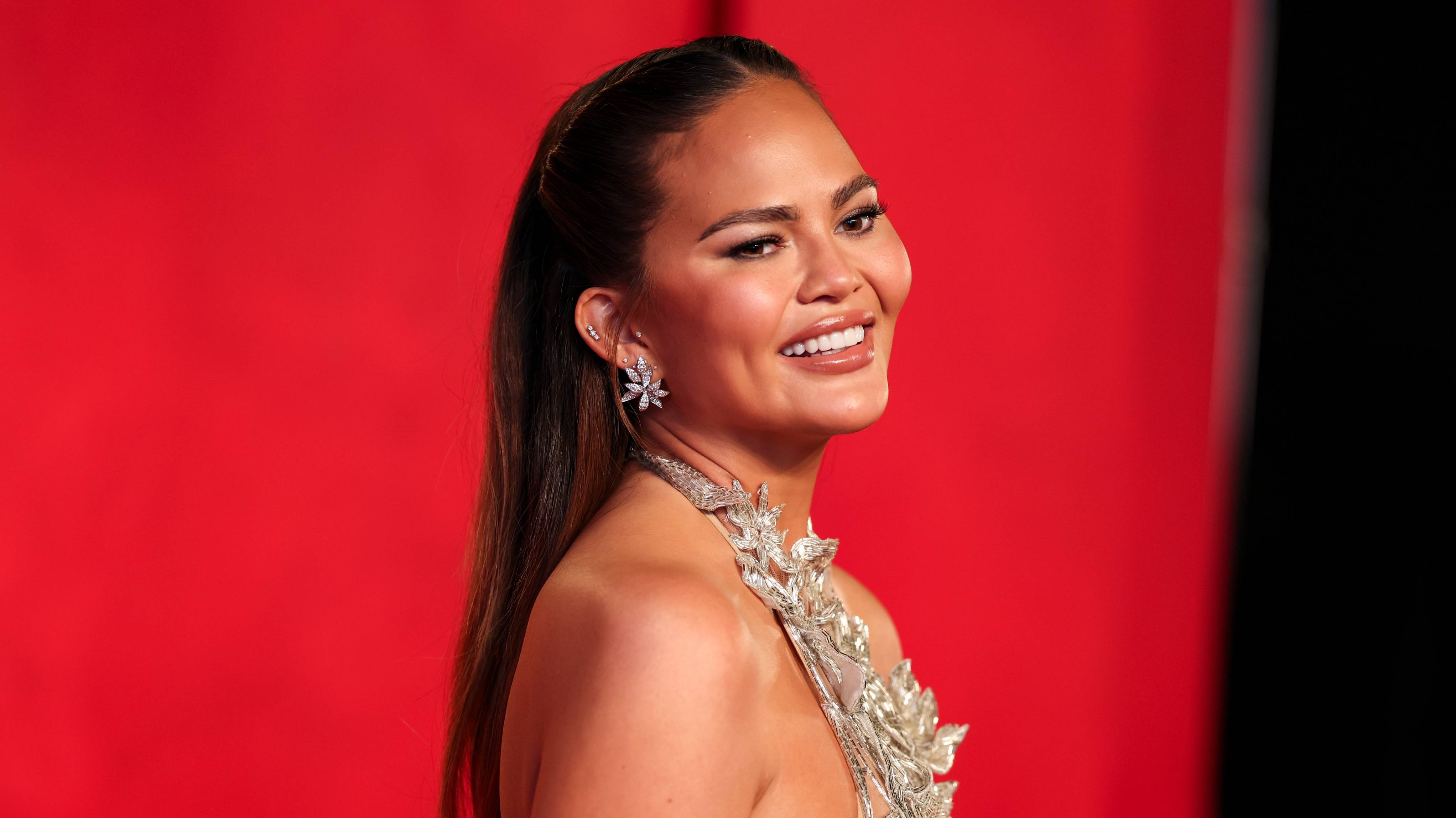

(Photo: Tomitheos Linardos/Getty Images)