Photos: Get the Facts on Prepaid Cards

Prepaid credit cards have many benefits.

1 / 10

Prepaid Cards - Prepaid cards have many benefits, especially for those trying to build, maintain or repair credit. The way it works is simple: you add money to the card (through direct deposit, in person deposit or PayPal), then use the card to buy things, pay bills or take out money whenever you need it. No need to worry about debt with these cards, since you can only spend the money you’ve added. They offer the convenience of credit cards minus the hassles of interest and overdraft fees or debt. Learn more in the following pages. Sponsored by www.Rushcard.com

2 / 10

Financial Control - Say good-bye to the temptation with $10,000-plus limit credit cards. With prepaid cards, you only spend what you have, not what some company gives you “credit” for, which makes it easier to control your cash flow. Sponsored by www.Rushcard.com (Photo: Danny Moloshok /Landov)

Photo By Danny Moloshok/Landov

3 / 10

Don’t Worry About Debt - If you’re already paying thousands of dollars for credit mistakes of the past, no need to worry here. The prepaid cards won’t get you into more debt, since you can only spend what you have. And you never have to deal with a high-interest rate because you can only spend the money on your card. Sponsored by www.Rushcard.com (Photo: MCT /Landov)

4 / 10

Use at ATMs - Just like with bank and credit cards, you can have access to your money whenever you’d like. Customers can use their prepaid cards at most ATMs across the nation. Sponsored by www.Rushcard.com (Photo: EPA/JUSTIN LANE/LANDOV)

5 / 10

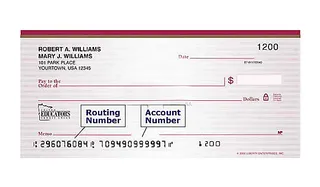

Direct Deposit - With direct deposit you can have your paycheck go directly to your prepaid card and immediately have access to that money to spend. Sponsored by www.Rushcard.com (Photo: Landov)

Photo By Photo: Landov

ADVERTISEMENT

6 / 10

They’re Secure - A card is a lot safer than traveling around with a wad of cash. For those who don’t have debit or credit cards as an option, having a prepaid card to store large amounts of money offers some peace of mind. If the card gets lost or stolen, depending on the terms, you can get the funds back. Sponsored by www.Rushcard.com (Photo: PA Photos /Landov)

7 / 10

Shop Online - You can use your card online to make purchases. Sponsored by www.Rushcard.com (Photo: REUTERS/Tim Chong/Landov)

Photo By Photo: REUTERS/Tim Chong/Landov

8 / 10

Parents Can Track Spending - Parents trying to teach their children about spending can track and monitor how their children use their prepaid cards through programs such as BillMyParents. Parents can load the card with as much money as they like and see when and where their children are spending. Sponsored by www.Rushcard.com (Photo: The Press-Register/Landov)

9 / 10

Build Credit - When you use your prepaid card to pay your rent, utilities and other bills, some prepaid card companies will report your regular bill payments to participating credit reporting agencies. Sponsored by www.Rushcard.com